How is Gold Formed and Processed?

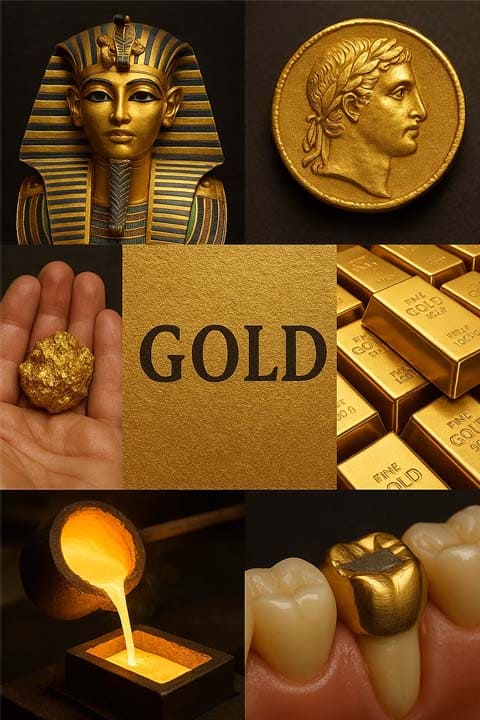

Behind every war, there’s a shadow of gold. — This quote, echoed by many historians, captures the deep connection between war and wealth. Gold, with its brilliant luster, has always played a central role in shaping empires, stirring human greed, and inspiring the marvels of craftsmanship and civilization.

From the dazzling ornaments in ancient Egyptian tombs to the gold ingots of ancient China and the golden idols in Indian temples; from the medieval gold rushes to the establishment of the gold standard in modern finance—gold has consistently symbolized wealth, power, and security.

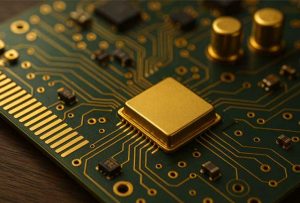

But gold is no longer confined to crowns and vaults. It now finds its place in every corner of our modern lives: conductive layers in electronic chips, radiation shielding in satellites, and even dental materials in medical applications. Gold has evolved from a symbol of wealth to a pillar of technological civilization.

In this article, we’ll explore gold from multiple perspectives: its origins, purity levels, refining processes, industrial applications, and its transformative role in the modern world. Whether you’re a gold investor, a jewelry enthusiast, or a professional in the tech industry, this golden journey is sure to enlighten and inspire.

“Gold is the corpse of value”⋯ Neal Stephenson.

The above quote is a simple yet succinct summary of what gold has come to represent both in ancient and modern society. Gold is symbolic of value both literally and metaphorically. At a current price of about $1,300 per ounce, gold is one of the most expensive substances on earth.

The business of selling, purchasing and processing of gold into jewelries and other materials has grown into a very profitable industry. China (14%), Russia (9%) and Australia (8%) are the top three producers of raw gold bullion which is the raw material for producing jewelry.

These three countries and others have a total world production value of $119billion. This value was in 2014 according to bullionvault and has definitely increased in recent years. Unfortunately, the profitability of this business has also attracted the attention of dishonest people. These criminally minded individuals have learnt to combine various inexpensive metals and coat them to have the appearance and shape of pure gold.

Many people have unwittingly become victims of these criminals, losing vast sums of money as payments for “original gold jewelry products”. The advent of technology has made it seemingly easier for these forgers to carry out their trade. Despite all of this, there are still some subtle methods by which fake gold can be identified. This article will give you basic tips and pointers to quickly identify fake gold and differentiate it from the real thing.

Let’s dive right in:

Chapter 1:Origins of Gold: Where does gold come from?>>

Gold, one of the most coveted elements on Earth, has an origin story that stretches far beyond our planet — it begins in the stars. Scientific research suggests that gold was formed billions of years ago during supernova explosions and neutron star collisions, where immense energy fused atomic particles to create heavy elements like gold. These cosmic events scattered gold throughout the universe, some of which eventually became part of Earth during its formation.

- Natural Sources of Gold on Earth

Once on Earth, gold is found in the crust in various forms:

- Primary (Lode) Gold Deposits

Gold embedded in hard rock, often alongside quartz veins. These are typically mined deep underground or in open pits using explosives and heavy machinery.

- Secondary (Placer) Gold Deposits

Gold particles or nuggets that have eroded from lode sources and accumulated in riverbeds, sand, or gravel. Placer mining involves panning, dredging, or sluicing to extract gold from alluvial deposits.

- Alluvial Gold

Found in river sediments, this type of gold is often the target of traditional gold panning and is generally more accessible to small-scale miners.

①Primary gold vs. recycled gold (mining vs. recycling)

Primary Gold vs Recycled Gold: Mining vs Recovery

When we talk about the origin of gold, it’s essential to understand that not all gold is newly mined from the earth. The global gold supply actually comes from two main sources: primary (mined) gold and recycled (secondary) gold.

1. Primary Gold: Extracted from Nature

Primary gold, also known as newly mined gold, is obtained directly from natural geological sources through various mining methods. This includes both hard rock (lode) mining and placer (alluvial) mining.

Characteristics:

Extracted from gold-rich ore deposits.

Requires intensive labor, machinery, and environmental management.

Involves processes such as crushing, milling, flotation, cyanidation, and smelting.

Often used to produce gold bars and coins for investment and central bank reserves.

Major Producing Countries:

China, Australia, Russia, the United States, Canada, South Africa

2. Recycled Gold: Gold from the Past

Recycled gold, also known as secondary gold, is recovered from previously used products. Rather than mining new gold from the earth, this method extracts gold from:

Old or broken jewelry

Industrial components (like circuit boards and connectors)

Dental alloys

Scrap from gold refining and fabrication processes

Characteristics:

Environmentally friendly and energy-efficient compared to mining.

Accounts for about 25–30% of the annual gold supply.

Plays a crucial role in supporting a circular economy.

Can be refined to the same purity as freshly mined gold (e.g., 99.99%).

Comparison Table: Primary Gold vs Recycled Gold

| Feature | Primary Gold (Mined) | Recycled Gold (Recovered) |

|---|---|---|

| Source | Natural gold ore or deposits | Used jewelry, electronics, etc. |

| Environmental Impact | High (mining, land use, waste) | Lower (less waste, no new mining) |

| Cost of Extraction | High (equipment, labor, energy) | Lower (melting & refining) |

| Supply Share | ~70–75% of total annual supply | ~25–30% of total annual supply |

| Purity After Refining | Up to 99.99% | Up to 99.99% |

Conclusion:

While mined gold continues to dominate global supply, recycled gold is becoming increasingly important in a world that values sustainability and resource efficiency. Both sources ultimately deliver gold of equal purity—but with very different environmental and economic footprints.

②Primary gold vs. recycled gold (mining vs. recycling)

Major Gold-Producing Regions Around the World

Gold is mined on almost every continent, but only a few countries dominate global production. These top producers possess rich geological resources, advanced mining technologies, and large-scale industrial infrastructure. Below are some of the most important gold-producing countries:

🇨🇳 China – The World’s Top Gold Producer

Annual Production: ~400 tons

Key Mining Regions: Shandong, Henan, Inner Mongolia, Yunnan

Notable Mines: Sanshandao Mine (Shandong), Jiaojia Gold Mine

Highlights:

China has been the world’s largest gold producer since 2007. It also has a strong domestic demand for jewelry and investment gold. Most of China’s production comes from underground hard-rock mining.

🇦🇺 Australia – Rich in Reserves and Open-Pit Mines

Annual Production: ~320 tons

Key Mining Regions: Western Australia (Kalgoorlie, Super Pit), New South Wales

Notable Mines: Boddington, Super Pit (Kalgoorlie), Cadia East

Highlights:

Australia boasts some of the largest untapped gold reserves globally. Its mining industry benefits from efficient open-pit methods and world-class ore grades. Gold is a key export commodity for Australia.

🇷🇺 Russia – A Strategic Gold Power

Annual Production: ~300 tons

Key Mining Regions: Siberia, Far East, Magadan, Krasnoyarsk

Notable Companies: Polyus Gold (largest in Russia)

Highlights:

Russia is not only a top producer but also a major reserve holder. It strategically stockpiles domestic gold and uses it as a hedge in foreign reserves. Much of the production occurs in remote and harsh climates.

🇿🇦 South Africa – Once the Gold Capital of the World

Annual Production: ~100 tons (declining)

Key Mining Regions: Witwatersrand Basin, Gauteng Province

Famous Mines: Mponeng (deepest gold mine in the world)

Highlights:

South Africa dominated global gold production in the 20th century, but its output has declined due to aging mines and rising costs. However, it still holds significant historical importance and deep underground mining expertise.

Other Notable Producers:

| Country | Annual Output | Key Fact |

|---|---|---|

| United States | ~190 tons | Nevada’s Carlin Trend is one of the richest gold belts globally |

| Canada | ~170 tons | Strong investment in modern exploration and sustainability |

| Peru | ~110 tons | Major player in South America, often combined with silver mining |

| Indonesia | ~100 tons | Home to the Grasberg mine, one of the world’s largest gold & copper mines |

Summary:

The global gold supply is highly concentrated among a few nations, with China, Australia, and Russia leading the way. Each country’s gold mining industry is shaped by its geography, political environment, and technological development.

③The forms of gold in nature (placer gold, quartz vein gold, alloy state)

Gold doesn’t typically appear in nature as shiny bars or nuggets — instead, it exists in a variety of geological forms, depending on how it was deposited over millions of years. Understanding these natural forms is essential for identifying gold-bearing deposits and selecting the right extraction methods.

1. Placer Gold (Alluvial Gold)

Description: Small particles, flakes, or nuggets of gold found in riverbeds, sand, or gravel.

Formation: Created when primary gold deposits erode over time. Water carries and concentrates the heavier gold particles in low-lying areas.

Mining Method: Surface methods such as gold panning, sluicing, and dredging.

Appearance: Typically smooth, rounded, and bright due to water polishing.

Example Locations: Yukon (Canada), California (USA), Ghana, Indonesia

2. Lode Gold (Quartz Vein Gold / Primary Gold)

Description: Gold that is embedded in rock, often in quartz veins or associated with sulfide minerals.

Formation: Deposited by hydrothermal fluids moving through cracks in the Earth’s crust.

Mining Method: Underground or open-pit hard-rock mining, followed by crushing and chemical extraction.

Appearance: Gold appears as fine grains or wires within quartz or rock matrix.

Example Locations: South Africa (Witwatersrand Basin), Western Australia, China (Shandong)

3. Gold in Alloyed or Combined Form

Description: Gold that occurs naturally combined with other metals or elements, forming natural alloys.

Common Companions: Silver (forming electrum), tellurium (forming calaverite), copper.

Mining Considerations: Requires more advanced separation and refining processes to extract pure gold.

Significance: Electrum was used in ancient coins and jewelry due to its attractive color and workability.

Summary Table: Forms of Natural Gold

| Form | Found In | Appearance | Mining Method |

|---|---|---|---|

| Placer Gold | Riverbeds, sediments | Flakes, nuggets | Panning, dredging |

| Lode/Quartz Gold | Hard rock veins | In quartz, sulfides | Crushing, cyanidation |

| Alloyed Gold | Combined with metals | Silver-gold mix (electrum), tellurides | Smelting, electro-refining |

Gold’s natural forms influence how it’s discovered, mined, and processed. While placer gold is easier to extract, lode and alloyed gold often require complex mining and refining technologies. Each form tells a story about the geological history of the land — and shapes the economic value of the deposit.

Chapter 2: How gold is obtained: the journey from ore to nugget>>

The creation of gold begins billions of years ago through geological processes, and its extraction today is a feat of modern engineering. The journey starts with 1-5 years of exploration, using geochemical sampling and core drilling to identify viable deposits (minimum 1g/t grade). Mining methods vary: open-pit operations (costing ~$800/oz) extract near-surface ore, while underground mines reach depths of 4,000 meters; alluvial mining processes 5,000m³ of sediment daily but requires strict ecological restoration.

The ore undergoes a three-stage crushing and grinding process to achieve 200-mesh fineness, followed by precision extraction—gravity separation recovers coarse gold, flotation captures fine particles, and cyanidation (95%+ recovery) leaches residual traces. Smelting at 1,200°C produces doré bars (90% purity), which are then dissolved in aqua regia, chemically reduced, and arc-cast into 400-oz (12.5kg) LBMA-standard bullion of 99.99%+ purity, each stamped with a unique ID and verified by ICP-MS (impurities <0.005%).

Today, bioleaching cuts costs by 30%, cyanide-free alternatives reduce pollution, and “urban mining” yields 300g of gold from 1 ton of discarded phones (far exceeding ore grades). Though average gold grades have plummeted from 20g/t in 1900 to 1.5g/t today, innovation ensures this “earth-to-hand” journey continues, transforming ancient treasure into modern value.

①Gold mining methods: open pit mining vs underground mining

1. Open-Pit Mining

Best for: Shallow deposits (<500m depth) with low-to-medium grade (1-4g/t)

Key Features:

Cost: $800-$1,200/oz (30-50% cheaper than underground)

Productivity: Moves 50,000-100,000 tons of material daily

Recovery Rate: 90-95% (better for oxidized ores)

Equipment: 200-ton haul trucks, 10m³ electric shovels

Slope Angle: 45°-55° for stability

Process Flow:

Overburden Removal: Strip 10:1 waste-to-ore ratio

Blasting: ANFO explosives break 15m benches

Hauling: 240-ton trucks transport ore to crusher

Pros:

✓ Higher production rates

✓ Lower operating costs

✓ Safer working conditions

Cons:

✗ Massive environmental footprint

✗ Limited to shallow deposits

2. Underground Mining

Best for: High-grade veins (>5g/t) below 500m

Key Methods:

| Type | Depth | Cost | Use Case |

|---|---|---|---|

| Cut-and-Fill | 500-1,500m | $1,500-$2,000/oz | Steeply dipping veins |

| Block Caving | 1,000m+ | $1,000-$1,500/oz | Massive low-grade ores |

Critical Infrastructure:

Shafts: 5-8m diameter, 1km deep

Ventilation: 100-200 m³/s airflow

Ground Support: Rock bolts + shotcrete

Pros:

✓ Accesses deep, high-grade ores

✓ Smaller surface disturbance

Cons:

✗ 3-5x higher operating costs

✗ Greater safety risks (rock bursts, gas)

| Parameter | Open-Pit Favored When… | Underground Favored When… |

|---|---|---|

| Ore Grade | <4 g/t | >5 g/t |

| Depth | <500m | >500m |

| Deposit Shape | Blanket-like | Narrow veins |

| Capital Budget | $500M-$1B | $1B+ |

| Environmental Limits | Permitted | Restricted areas |

Modern Trend: Many mines start as open-pit then transition underground (e.g., Super Pit → Fimiston Underground)

Did You Know? The world’s deepest mine (Mponeng, South Africa) operates at 4km depth with rock temperatures of 66°C, requiring ice slurry cooling systems.

②Ore dressing and enrichment technology: gravity separation, flotation, cyanidation gold extraction

1. Gravity Separation (Physical Method)

Principle: Uses density differences to separate gold (19.3 g/cm³) from lighter gangue minerals (~2.7 g/cm³).

Key Equipment & Processes

| Method | Recovery Rate | Gold Particle Size | Pros & Cons |

|---|---|---|---|

| Jigging | 30-50% | >0.1 mm | ✓ Low cost ✗ Low recovery |

| Shaking Table | 40-60% | 0.05–2 mm | ✓ High precision ✗ Slow throughput |

| Centrifugal Concentrator | 60-80% | 0.02–0.5 mm | ✓ High recovery ✗ High energy use |

Best For:

Coarse-grained free gold (placer/alluvial deposits)

Pre-concentration before cyanidation/flotation

2. Froth Flotation (Physicochemical Method)

Principle: Hydrophobic gold particles attach to air bubbles, separating from hydrophilic waste.

Key Parameters

| Factor | Optimal Condition | Effect on Recovery |

|---|---|---|

| Collector | Xanthates (e.g., PAX) | Enhances gold adhesion |

| pH | 8–10 (alkaline) | Prevents pyrite flotation |

| Particle Size | 0.01–0.5 mm | Too fine = low recovery |

Recovery: 85–95% for sulfide-associated gold.

Limitations:

Ineffective for coarse gold (>0.5 mm)

Requires grinding to ultrafine sizes

Modern Advancements:

Flash Flotation – Recovers fast-settling gold early in grinding circuit.

Jameson Cell – High-intensity froth recovery for fine particles.

3. Cyanidation (Chemical Leaching)

Principle: Gold dissolves in cyanide (NaCN/KCN) solution, then recovered via adsorption or precipitation.

Process Variations

| Method | Recovery | Time | Cost |

|---|---|---|---|

| CIL (Carbon-in-Leach) | 90–96% | 24–48 hrs | $$$ |

| CIP (Carbon-in-Pulp) | 88–94% | 18–36 hrs | $$ |

| Heap Leaching | 60–75% | 30–90 days | $ |

Key Factors Affecting Efficiency:

Oxygen Supply (critical for Au dissolution)

Cyanide Concentration (0.01–0.05% NaCN)

Particle Size (must be <75 µm for optimal leaching)

Environmental Concerns:

Cyanide detoxification (H₂O₂, SO₂/air) is mandatory.

Alternative Lixiviants (thiosulfate, glycine) being tested.

4. Technology Selection Guide

| Ore Type | Best Method | Why? |

|---|---|---|

| Coarse free gold | Gravity + Cyanidation | Maximizes recovery |

| Fine refractory gold | Flotation → Roasting → Cyanidation | Liberates locked gold |

| Low-grade oxide ore | Heap Leaching | Cost-effective |

Emerging Trends

Hybrid Circuits (e.g., Gravity→Flotation→CIL for 95%+ recovery)

Non-cyanide Leaching (e.g., “Clean Mining” thiosulfate process)

Sensor-Based Sorting – Pre-concentrate ore pre-processing.

Conclusion: A well-designed flowsheet combines gravity, flotation, and cyanidation for optimal gold recovery while minimizing costs and environmental impact.

③Ore dressing and enrichment technology: gravity separation, flotation, cyanidation gold extraction

Pyrometallurgy (Fire Assay / Smelting)

Principle: High-temperature separation of gold from impurities using fluxes and reducing agents.

Process Steps

Melting (1200–1400°C)

Input: Doré bullion (80–95% Au) or gold concentrate

Fluxes:

Borax (lowers melting point)

Soda ash (removes silica)

Litharge (PbO, captures precious metals)

Slag Formation

Impurities (Fe, SiO₂, Cu) form a molten slag layer

Gold-silver-lead alloy (Pb-Au-Ag) sinks to bottom

Cupellation

Lead oxidizes, leaving gold-silver alloy (~95% purity)

Recovery Rate: 97–99%

Energy Use: 300–500 kWh per ton of ore

Pros:

✓ Handles high impurity loads

✓ Cost-effective for bulk processing

Cons:

✗ Toxic lead emissions (requires scrubbers)

✗ Lower final purity (needs further refining)

Electrolytic Refining (Miller & Wohlwill Processes)

Principle: Electrochemical dissolution and re-deposition of pure gold.

A. Miller Process (Chlorination + Electrolysis)

| Step | Chemical Reaction | Purpose |

|---|---|---|

| Chlorination | Au + 3Cl₂ → 2AuCl₃ (250°C) | Removes Ag/Pt/Pd |

| Electrolysis | AuCl₃ → Au³⁺ + 3Cl⁻ (HCl electrolyte) | Pure Au deposition |

Output: 99.5–99.8% pure gold

B. Wohlwill Process (Higher Purity)

| Parameter | Details |

|---|---|

| Anode | Crude gold (95%) |

| Cathode | Titanium/stainless steel |

| Electrolyte | Gold chloride (HAuCl₄) in HCl |

| Voltage | 3–5 V DC |

| Purity Achieved | 99.99%+ (4N) |

Energy Use: 1,000–1,500 kWh per kg of gold

Pros:

✓ Ultra-high purity (LBMA standard)

✓ Recovers platinum group metals (PGMs)

Cons:

✗ High operational cost

✗ Requires pre-refined gold (≥95%)

Comparison: Pyrometallurgy vs. Electrolysis

| Factor | Smelting | Electrolysis |

|---|---|---|

| Purity | 95–99% | 99.5–99.99% |

| Speed | Faster (hours) | Slower (days) |

| Cost | Lower ($50–100/kg) | Higher ($200–300/kg) |

| Toxicity | Lead/SO₂ emissions | Acid/chlorine hazards |

| Best For | Bulk doré processing | High-purity investment gold |

Emerging Refining Technologies

Aqua Regia Process

Dissolves gold in HCl:HNO₃ → precipitates with NaHSO₃

Used by small refiners (purity: 99.9%)

Plasma Arc Smelting

10,000°C plasma torch vaporizes impurities

Zero chemical waste (but high energy use)

Green Refining (Non-Cyanide)

Thiosulfate or glycine leaching → electrowinning

Industry Trend: Major refineries (e.g., Valcambi, PAMP) combine smelting + electrolysis for efficiency.

Key Takeaways

For miners: Smelting is ideal for initial doré bar production.

For refiners: Electrolysis (Wohlwill) ensures 4N+ purity for central banks.

For recyclers: Aqua regia is common for e-waste/scrap gold.

④Gold ingot casting: cooling, forming and rolling

The process of turning refined gold into a solid, standardized gold bar involves several precise and controlled steps. After gold is refined to the desired purity—typically 99.99%—the metal is melted in a high-temperature induction furnace, reaching temperatures over 1,100°C.

Once molten, the gold is carefully poured into preheated graphite molds. These molds define the final shape and size of the gold bar, ranging from small 100g bars to large 12.5kg institutional bars. The mold must be evenly heated to prevent thermal shock and ensure a smooth, void-free surface on the cast bar.

After pouring, the gold is left to cool either in ambient air or under controlled cooling systems, depending on production needs. Once solidified, the bar is removed from the mold, inspected for any surface imperfections, and cleaned.

In some cases, to achieve a more uniform appearance or to prepare the bar for minting, the gold may undergo rolling and flattening. This is done using a rolling mill, where the gold is compressed and leveled to achieve specific thickness and surface texture.

Finally, for bars that are intended for investment or institutional use, laser engraving or stamping is applied—marking the purity, weight, refiner’s mark, and unique serial number. The result is a professionally cast gold bar, ready for trade, investment, or storage.

⑤Introduction to commonly used equipment: gold ore dressing equipment, smelting furnace, ingot casting machine, etc.

Common Equipment in Gold Processing: Ore Dressing Equipment, Smelting Furnace, and Ingot Casting Machine

In the gold production process, a range of equipment is essential for transforming raw ore into pure, tradable gold bars. Among these, ore dressing equipment plays an important role at the initial stage, separating valuable gold from impurities. This stage typically involves crushers, grinding mills, vibrating screens, and classifiers to reduce the ore to manageable particle sizes for further processing.

Smelting Furnace: Superbmelt Induction Melting Furnace

The smelting stage is critical for converting gold concentrate or recycled gold into a molten state. The Superbmelt Induction Melting Furnace is a state-of-the-art solution for this purpose. Available in various capacities (1kg to 250kg), this furnace uses medium frequency induction technology for fast, uniform, and energy-efficient melting. Key features include:

Melting Speed: Melts gold in 3–10 minutes depending on quantity.

Temperature Control: Reaches up to 1600°C with precise digital control.

Crucible Compatibility: Supports graphite, SIC, and ceramic crucibles.

Safety Systems: Equipped with overvoltage, overcurrent, and water shortage protection.

Applications: Ideal for both virgin gold from mining and recycled scrap gold.

Ingot Casting Machine: Superbmelt Gold Bar Making Machine

After smelting, molten gold is poured into molds to form bars. The Superbmelt Ingot Casting Machine automates this step with high precision and consistency. This equipment ensures uniform bar weight, shape, and surface finish, critical for commercial or central bank gold production. Key highlights:

Vacuum and Inert Gas Protection: Prevents oxidation and porosity.

Automatic Pouring System: Reduces human error and improves safety.

Mold Customization: Supports various bar sizes from 1g to 15kg.

Rapid Cooling Technology: Accelerates production without compromising bar integrity.

Optional Touchscreen Interface: For programmable and repeatable casting cycles.

Together, these Superbmelt machines create a seamless production line from molten gold to finished bars—trusted by gold refineries, bullion producers, and precious metal recycling facilities worldwide.

Chapter 3: Gold purity and grading standards>>

Gold Purity refers to the proportion of gold in metal products, usually expressed in thousandths (‰) or percentages (%). The internationally accepted notation is “Au+number” (such as Au999.9).

①Introduction to commonly used equipment: gold ore dressing equipment, smelting furnace, ingot casting machine, etc.

Gold purity refers to the amount of pure gold contained in a given piece of gold material, usually expressed in parts per thousand (‰) or karats. The higher the number, the purer the gold. For example, Au999.9 means the gold content is 99.99% pure, also known as 24-karat gold, which is considered almost entirely free from other metals or impurities.

Here’s a breakdown of common purity levels:

Au999.9 – 99.99% pure gold (24K), often used in gold bars and investment-grade bullion.

Au999 – 99.9% pure gold, also suitable for gold coins and bars.

Au916 – 91.6% gold (22K), commonly used in high-quality jewelry.

Au750 – 75% gold (18K), widely used in designer jewelry.

Au585 – 58.5% gold (14K), durable and popular for everyday wear.

Understanding gold purity is important for evaluating value, investment quality, and suitable applications, whether for jewelry, electronics, or bullion production.

②Certification standards of different countries/exchanges (LBMA, COMEX, SGE, etc.)

1. LBMA (London Bullion Market Associa

Overview:

ThCertification:

LBMA “GPurity Standard:

Minimum 995 parts per thousanSig

LBMA certif

2. COMEX

Overvi

COMEX is a leading U.S. futures and options exchange for goldCe

COMEX aPurity Standard:

Minimum 995 parts pSignificance:

Gold futures contracts on COMEX are among the most liquid and widely used for price discovery and hedging.

3. SGE (Shanghai Gold Exchange, China)

Overview:

SGE is the dominant gold exchange in China, governing physical gold trading in the domestic market.Certification:

SGE requires refiners to be “SGE Certified” with stringent quality controls. The gold bars traded typically have purity of at least 999 (99.9%).Purity Standard:

Usually 999 parts per thousand (99.9%) or higher.Significance:

SGE certification is essential for gold trading within China and increasingly recognized internationally as China’s market grows.

4. Other Important Certification Bodies

PMI (Paris Metal Institute): Oversees quality and standardization in European markets.

Tokyo Commodity Exchange (TOCOM): Japan’s main precious metals market, with its own bar standards.

Swiss Refiners Association: Swiss refiners are known for producing LBMA-accredited bars.

Summary Table

| Exchange / Body | Location | Purity Standard | Bar Weight | Certification Purpose |

|---|---|---|---|---|

| LBMA | London, UK | ≥ 995 (99.5%) | ~400 oz (12.4 kg) | Global wholesale market standard |

| COMEX | New York, USA | ≥ 995 (99.5%) | 100 oz (~3.11 kg) | Futures market trading |

| SGE | Shanghai, China | ≥ 999 (99.9%) | 1 kg bars typical | Chinese domestic & international trade |

| PMI | Paris, France | Varies | Varies | European market quality |

| TOCOM | Tokyo, Japan | Varies | Varies | Japanese commodity market |

③How to test gold purity? (Specific gravity, XRF, fire assay, etc.)

1. Specific Gravity Method

This is a basic and non-destructive technique where the density of the metal is measured and compared with pure gold’s density (19.32 g/cm³). Though simple, it may produce errors due to surface impurities or if the gold is alloyed with other metals.

2. X-Ray Fluorescence (XRF) Spectrometry – Non-Destructive & Fast

The XRF method is widely used due to its speed, accuracy, and non-destructive nature. SuperbMelt’s Desktop XRF Gold Tester offers a high-performance, professional solution to test gold purity within seconds.

Key Features of SuperbMelt XRF Gold Tester:

Accuracy: Detects gold content as high as 999.99 purity (Au).

Speed: Provides test results within 10–30 seconds.

No Sample Damage: No need to melt or scratch the gold.

Elemental Breakdown: Simultaneously analyzes other metals like silver, copper, palladium, and platinum.

User-Friendly Interface: Touchscreen control and easy-to-read results.

How it works:

The XRF device emits X-rays that strike the atoms in the gold sample, causing them to emit secondary (fluorescent) X-rays. Each element emits X-rays at a specific energy level, which the detector uses to identify and quantify the gold and other metals present.

This method is ideal for:

Gold refiners

Pawn shops

Jewelry stores

Precious metal investors

3. Fire Assay (Cupellation Method)

This traditional method is known for its extreme accuracy and is considered the industry standard. It involves melting the sample with lead and separating the precious metal through oxidation. While precise, it is destructive, time-consuming, and requires laboratory conditions.

If you’d like to include the technical specifications or images from SuperbMelt’s official XRF page, I can help summarize or format those as well.

Chapter 4: What can gold do? The main uses of gold>>

1. Financial & Investment

A. Monetary Gold

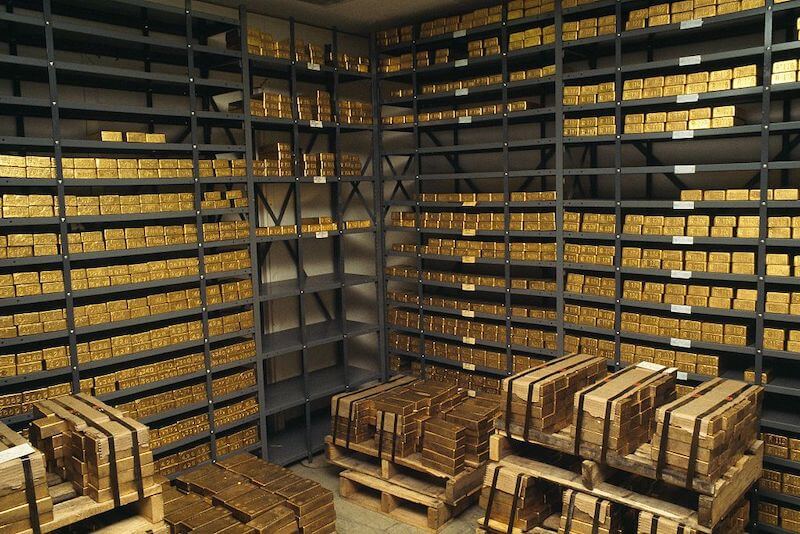

Central Bank Reserves: ~35,000 tons held globally (IMF 2024)

Gold-Backed ETFs: Funds like SPDR Gold Shares (GLD) hold physical bars

B. Retail Investment

Bullion Bars: 1oz to 400oz (LBMA standard)

Coins: American Eagle, Canadian Maple Leaf (9999 purity)

Why Gold?

✓ Hedge against inflation/currency devaluation

✓ Highly liquid asset (24/7 trading)

2. Jewelry & Luxury Goods

Global Demand: ~2,200 tons/year (50% of total supply)

Common Alloys:

18K (750): 75% gold + 25% copper/silver (durable for rings)

22K (916): 91.6% gold (popular in Middle East/India)

Trend: Lab-grown gold jewelry emerging (eco-friendly alternative)

3. Technology & Electronics

A. Electronics (Annual Use: ~300 Tons)

Semiconductors: Gold bonding wires (99.99% purity) in microchips

Connectors: USB/HDMI ports use gold plating (0.1µm thick)

B. Aerospace & Defense

Satellites: Gold-coated films reflect infrared radiation

Jet Engines: Gold-alloy seals withstand 1,000°C+

Key Property:

✓ Highest corrosion resistance among metals (zero oxidation)

4. Medical & Dental

A. Dentistry (Annual Use: ~50 Tons)

Crowns/Bridges: Gold alloys (Au-Pd-Ag) resist bacterial growth

B. Medicine

Cancer Treatment: Gold nanoparticles in radiotherapy

Diagnostics: Rapid COVID-19 tests use gold colloids

Advantage:

✓ Biocompatible (non-toxic to humans)

5. Industrial & Chemical

Catalysts: Gold-palladium alloys convert CO to CO₂ in factories

Glassmaking: 0.01% gold creates cranberry glass (artistic/UV-filtering)

Niche Use:

Gold Leaf: 0.1µm sheets gild architectural masterpieces

6. Emerging Technologies

Quantum Computing: Gold superconductors at near-absolute zero

Nanotech: Gold “nano-shells” target drug delivery

Gold’s Unique Value Chain

| Sector | Purity Requirement | Price Sensitivity |

|---|---|---|

| Investment | 999–9999 | High (spot price-driven) |

| Electronics | 9999–99999 | Extreme (tech specs critical) |

| Jewelry | 750–999 | Medium (design matters) |

Did You Know?

A single iPhone contains ~0.034g gold ($2 at spot prices)

All gold ever mined would fit in 3 Olympic swimming pools (~209,000 tons)

Conclusion: From ancient currencies to Mars rovers, gold remains humanity’s most versatile precious metal—blending wealth, utility, and beauty.

Chapter 5: Gold application cases in different industries>>

1. Finance & Investment

Case 1: Central Bank Gold Reserves

Example: The U.S. Federal Reserve holds 8,133 tons of gold (Fort Knox, NY Fed vaults).

Why Gold? Acts as a crisis hedge (e.g., 2008 financial crash).

Case 2: Gold-Backed ETFs

Example: SPDR Gold Shares (GLD) stores ~900 tons in LBMA-approved vaults.

Function: Allows stock-market investors to own “paper gold.”

2. Jewelry & Luxury

Case 1: 24K Cultural Jewelry

Example: Indian bridal “Temple Jewelry” (999 purity) for weddings.

Trend: 18K Gold-Plated Smartwatches (e.g., Apple Watch Edition).

Case 2: Luxury Branding

Example: Rolex Daytona watches with 18K gold cases ($30k+).

3. Electronics & Tech

Case 1: Smartphone Circuitry

Example: iPhone 15 uses 0.034g gold in connectors/circuit boards.

Function: Prevents corrosion in micro-USB ports.

Case 2: Semiconductor Wire Bonding

Example: Intel CPUs use 99.99% gold wires to link silicon dies.

Why? Gold doesn’t oxidize, ensuring 20+ years of reliability.

4. Medical & Dental

Case 1: Dental Crowns

Example: Porcelain-Fused-to-Gold (PFG) crowns last 30+ years.

Advantage: Non-reactive with saliva/gums.

Case 2: Cancer Treatment

Example: Gold Nanoparticles in “AuroLase Therapy” (NanoSpectra Bioscience) target tumors.

5. Aerospace & Defense

Case 1: Satellite Components

Example: James Webb Space Telescope’s mirrors coated with 100nm gold layer.

Purpose: Reflects infrared light (98% efficiency).

Case 2: Jet Engine Seals

Example: GE Aviation uses Au-Ni alloys in turbine seals.

Benefit: Withstands 1,200°C heat.

6. Industrial & Chemical

Case 1: Pollution Control

Example: Volkswagen catalytic converters with gold-palladium catalysts.

Case 2: Specialty Glass

Example: Schott Glass uses gold nanoparticles for UV-blocking windows.

7. Emerging Technologies

Case 1: Quantum Computing

Example: Google’s Sycamore chip uses gold superconducting circuits.

Case 2: Nanomedicine

Example: Gold Nanorods deliver drugs to brain tumors (MIT research).

Chapter 6: Brief description of gold processing process>>

1. Mining & Extraction

Methods:

Open-pit: For shallow deposits (<500m, low-grade ore).

Underground: For high-grade veins (>5g/t, depths to 4km).

Output: Crushed ore (10–100mm particles).

2. Ore Dressing (Beneficiation)

Crushing/Grinding: Jaw crushers → Ball mills (to 0.074mm).

Concentration:

Gravity separation (shaking tables, centrifuges): Recovers coarse gold.

Froth flotation: Captures sulfide-bound gold.

Output: Gold concentrate (20–100g/t).

3. Gold Liberation & Extraction

Oxidized Ore: Direct cyanidation (NaCN solution dissolves gold).

Refractory Ore:

Roasting (600°C): Breaks sulfide locks.

BIOX® (Bacterial oxidation): Eco-friendly alternative.

Output: Gold-loaded solution (pregnant liquor).

4. Gold Recovery

Carbon Adsorption (CIP/CIL): Activated carbon captures gold from cyanide solution.

Electrowinning: Gold deposits onto steel wool cathodes.

Output: Gold “mud” (60–90% purity).

5. Refining to Pure Gold

Miller Process: Chlorination removes silver/platinum (99.5% pure).

Wohlwill Process: Electrolysis achieves 99.99%+ purity.

Output: LBMA-standard bars (400oz) or granules.

6. Recycling (Urban Mining)

Sources: E-waste, jewelry scrap, dental alloys.

Process: Aqua regia dissolution → Precipitation.

Efficiency: 1 ton smartphones ≈ 300g recoverable gold.

Key Metrics

Recovery Rate: 85–97% (modern plants).

Energy Use: 15–25kWh per ounce.

Water Use: 0.5–2m³ per ton ore.

Visual Tip: Imagine a flowchart with:Ore → Crushing → Grinding → Leaching → Recovery → Refining → Gold Bar

© Copyright 2008-2026 Superb Electromachinery Co., Limited

© Copyright 2008-2026 Superb Electromachinery Co., Limited